At SPOT Project, we believe that girl’s education has a huge impact on all of society and can save millions of lives. Educating girls is a key factor in helping a community escape poverty.

You can support the girls school through your Sadaqah and Lillah donations, you can ensure hard-working teachers are paid and the children are given the books and stationery needed to learn. Schools are integral to the health of any Muslim community. Support this project and play an invaluable role in safeguarding young vulnerable girls in the Gambia.

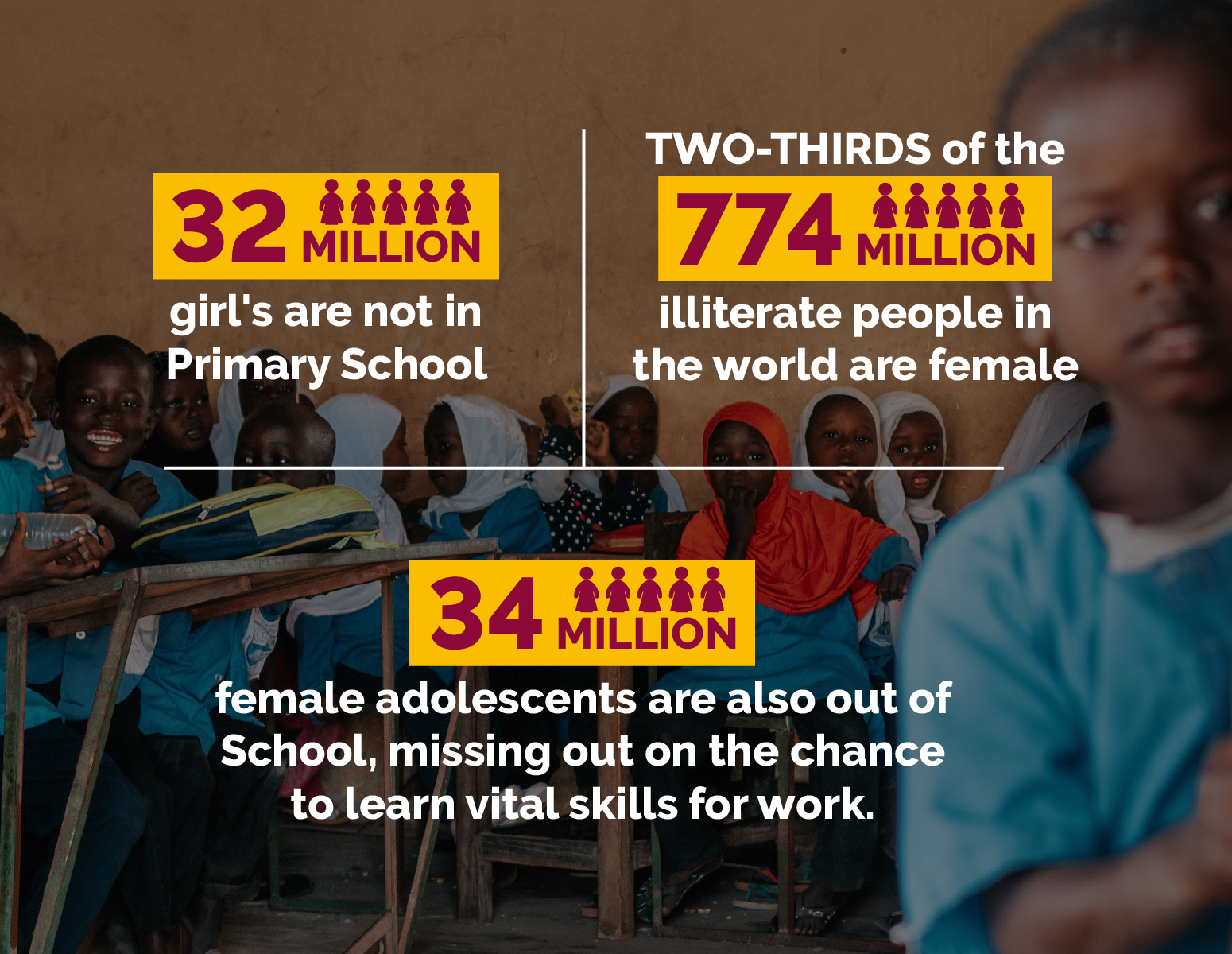

(UNESCO Institute for Statistics database)

(EFA Global Education Monitoring Report)