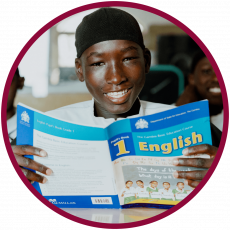

We have built a boarding school for Orphans which also acts as a community school for the local community. We pride ourselves on our positive ethos which supports and enhances the personal development and well-being of every child. As a vibrant institution, we provide learning opportunities in an environment where students are frequently challenged and encouraged to reach their full potential.

Our first task is to inspire these children and rebuild their faith in society. We receive them traumatised and distrusting of the notion of ‘good will’, so we work to stimulate their imagination and ambition. We aim to work on self confidence, raise aspirations and encourage creativity from a young age.

Once the children have successfully assimilated into our ecosystem at SPOT Academy and completed their journey of primary education and extra curricular activities. There will then be numerous opportunities for our students to learn trade skills in various industries as well as the national curriculum.

We provide education and training for further education in order to nurture the next generation of pioneers. By producing outstanding citizens and providing them with key life skills and opportunities, we aim to transform the landscape of the next generation. Changing hearts and minds is changing society.

Donate towards healthy nutritious meals and new clothing for the orphans at SPOT Academy.

At SPOT we take the wellbeing of our orphans highly, giving them the best quality of life.

Make an impact to our organisation by donating towards the electricity of our orphanage.